Debt can be a difficult burden that impacts your financial stability and your overall happiness. Whether it’s credit card debt, student loans, or other financial obligations, having a clear strategy for paying off debt is essential. In this blog post, I will explore one of the most effective systems to pay off debt, allowing you to regain control of your finances and work toward a debt-free future.

The Debt Snowball Method

The debt snowball method is a proven strategy for paying off debt that focuses on motivation and momentum. Popularized by financial expert Dave Ramsey, this method prioritizes small wins to keep you motivated throughout your debt repayment journey. The debt snowball method is known for its psychological approach to debt reduction.

List all of Your Debts: Begin by making a list of all your debts, including the outstanding balance, interest rate, and minimum monthly payment. Organize your debts from the smallest balance to the largest, regardless of interest rates. This step provides a clear picture of your debt landscape.

Build a Solid Budget: Before you can tackle your debts effectively, you need to create a realistic budget. Outline your monthly income and expenses to determine how much extra money you can allocate toward debt repayment. Cutting back on optional spending can free up more funds for your debt snowball.

Attack the Smallest Debt First: With your budget in place, direct all available extra funds toward paying off the smallest debt on your list while continuing to make minimum payments on your other debts. This approach may mean allocating larger payments than required on the smallest debt.

Celebrate Small Wins: Celebrate your accomplishment as you pay even the smallest debt. A sense of achievement will motivate you to continue tackling your debt. Take a moment to acknowledge your progress and remember that each paid-off debt brings you one step closer to financial freedom.

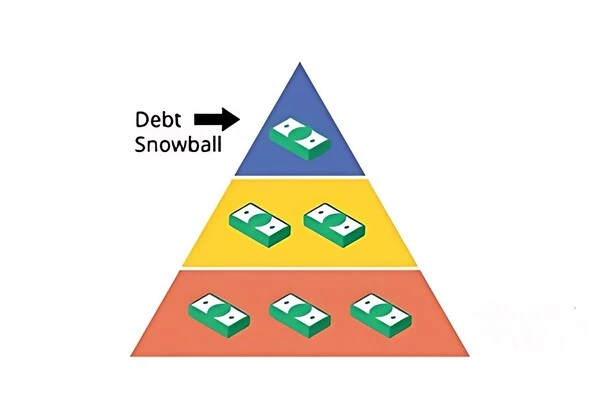

Snowball Effect: Once you’ve paid off the smallest debt, apply the amount you were paying on it (including the minimum payment) to the next smallest debt on your list. Your debt payments will gradually grow as you cross each item off your list, creating a snowball effect.

Repeat until debt-free: Continue doing this until you have paid off all of your debt. Each time you pay off a debt, you’ll have more money to allocate to the next one. This method not only speeds up your debt repayment but also builds financial discipline and performance.

Benefits of the Debt Snowball Method

The debt snowball method comes with a number of benefits. The main benefit of the debt snowball strategy is that it boosts motivation because you get results more quickly. The debt snowball method is straight-forward and easy to implement. It doesn’t require complex calculations or financial expertise. Starting with the smallest debt provides quick wins, which can be a huge motivator to keep you on track. As your debt payments increase with each paid-off debt, you’ll gain momentum toward your goal of becoming debt-free. This method encourages disciplined budgeting and spending habits, reinforcing positive financial behaviors. Paying off smaller debts first creates a sense of accomplishment and progress, boosting your confidence and commitment.

The debt snowball method is a highly effective system for paying off debt that focuses on motivation and builds momentum as you pay off your financial obligations one by one. While other debt repayment strategies may prioritize interest rates, the psychological benefits of the debt snowball can be a game-changer for those seeking to escape the cycle of debt. Start by listing your debts, creating a budget, and attacking the smallest debt first. You’ll get one step closer to financial freedom and a debt-free existence with each debt you pay off.