Funding is the lifeline of startups. Startups create value by solving existing problems .Entrepreneurs often come up with brilliant ideas for problem-solving, but those may not take off at all due to their inability to fundraise. For any startup entrepreneur looking to raise funds, it is crucial to know how the startup ecosystem works.

What is a startup ecosystem? It is a system of startups, organizations and people that work together to launch and scale startups. Usually this system is concentrated in a certain location. One of the best examples of a startup ecosystem is Silicon Valley in California.

The organizations in a startup ecosystem facilitate the establishment of startups. These include venture capital companies, startup incubators, startup accelerators, investor networks, universities, start-up competitions, media, event organizers, service providers (accounting, legal, etc.), crowdfunding portals, as well as advisory & mentoring organizations like Kore Facilitation which mentor startup entrepreneurs and provide business consulting services to their companies.

The players of a startup ecosystem are interdependent because they stand to benefit from each other. Founders need funding from investors. Investors invest in startups to make more money. People enjoy the products and services offered by startups-or find employment at startup companies.

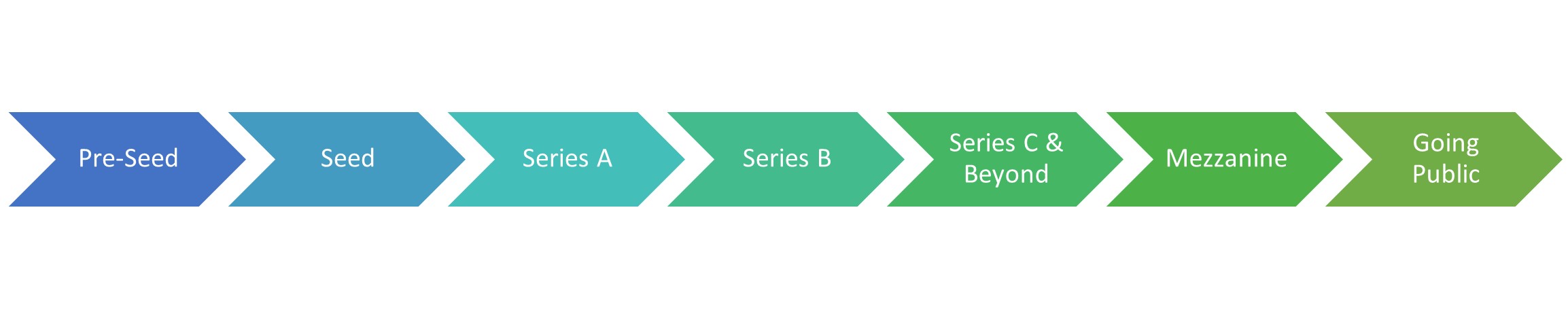

Startups generally raise funds in multiple rounds from various sources for different reasons over its life cycle. The various stages of startup funding may be summarized as follows:

Pre-Seed– This is the product/service development phase during which venture capitalists are unlikely to invest. Founders usually rely on friends and family or their own resources to fund operations during this time.Founders work on partnership agreements, copyrights or other legal matters which may affect the success of their business later on.

Seed- At this stage, founders need to develop a pitch deck to raise funds from outsiders in addition to fundraising from family and friends. Angel investors and early venture capitalists may be willing to invest, but since they are assuming a huge risk by investing so early on, they may take a large share of the startup’s equity in exchange. Funds raised at this point are used for market research, product development, creating a business plan and establishing a management team.

Series A– This is where venture capital financing begins in a startup’s life cycle. At this point, a startup has a pitch deck and business plan ready to demonstrate product-market fit to potential investors. Founders refine their product/service and scale up marketing efforts to acquire a customer base. Revenue starts flowing in, but founders need to show how their product/service will be profitable in the long run to attract investors. Venture capitalists, angel investors and startup accelerators generally invest in startups at this point.

Series B– At this stage, companies are ready to expand, for which they need more funds than in earlier stages. Venture capitalists assess the company’s performance and commercial viability of its product/service before making investment decisions. Funds are used to expand production and establish marketing, sales and customer service teams, and to make the product/service more competitive.

Series C and beyond– When a startup has reached this stage, it may be considered successful due to its exponential growth , established customer base and steady profits. New investments will enable the company to develop new products, enter new markets and take over other startups. Investors besides VC firms- like investment banks, private equity firms and hedge funds- are willing to invest at this point due to proven success of the startup and reduced risk associated with investment.

The mezzanine stage – This is also called the bridge stage or pre-public stage as it precedes going public, or involves a Merger & Acquisition event. The company has matured into a viable business, and many investors may sell off their shares for profit. New investors buy these shares in expectation of profits from an IPO in future. Companies need funds at this stage to pay for large events.

Going public/IPO–This refers to offering the company’s shares on the open market, marking the company’s transition from private to public. Founders and investors may sell shares on the open market to make profits.

The best choice of funding for an entrepreneur will hinge on the specific requirements of each startup as well as which investors are willing to invest. A general recommendation for entrepreneurs is to go for funding sources which let them access the required amount of funding while maintaining their budget and vision for the business.